Fall Market Update 2022

As we close out Q3 2022, we know you are likely concerned about the fluctuations in the stock market. Maybe these concerns have come up with friends, family, or tuning into the news. if you are feeling concerned, know that we are always available to discuss markets, the economy, the measures Cardinal is taking, and what it means for your unique financial plan.

We have continued to see volatility across both equities and fixed income markets. These markets have been largely impacted due to the war in Ukraine, supply chain shocks, and the persistent impact of inflation in 2022. Federal Reserve and other central banks around the world aggressively hiking interest rates in a desperate attempt to quell the historically high inflation levels we’ve been seeing.

Naturally, the markets haven’t reacted well to the rising rates and the uncertainty that comes with it. Year to date the S&P 500 Index (proxy for US large cap stocks) is down -21% and the Bloomberg US Aggregate Bond Index (proxy for overall US bond market) is down -14% (Source: Morningstar). There has been no place to “hide” this year during the historically rare situation where both global equities and global bonds experienced negative returns at the same time. Typically bonds act as a volatility buffer for equities in turbulent times. In 2022, persistent inflation, aggressive Federal Reserve rate hikes, and rising bond yields, have negatively impacted longer-term bonds and even short-term bonds.

Over the coming months, the Federal Reserve will remain resolute in their mission to fight inflation while hoping to avoid a recession at the same time. Until the impact of the rate hikes on inflation and the economy becomes clear, we expect continued market volatility. In the short term, the stock market could be trading in range through the US mid-term elections or into year end.

Despite the short-term discomfort, Cardinal Wealth Management is optimistic that the current market environment will not persist. Longer-term, we are more optimistic as historical bear markets tend not to last very long. Examining the S&P 500 Index’s declines of 20% or more from 1929-2021, the average bear market lasted 289 days with an average peak to trough drawdown of 36%. While history doesn’t dictate the future, bear markets are a natural part of investing in the market. The good news is that long-term market returns are positive the majority of the time.

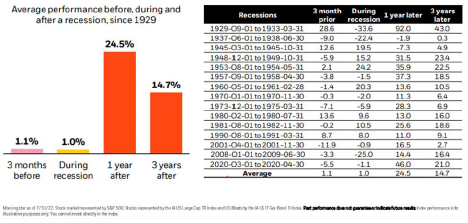

History shows that periods following bear markets and/or recessions provide opportunities for above normal market returns immediately following the market bottom.

We continue to be pleased with the results of our strategies and the actions we have taken to deal with this environment. Cardinal Wealth Management has been actively managing and adjusting client portfolios for this challenging rising rate environment with high inflation.

We are navigating these difficult markets by utilizing the following strategies:

- Tax Loss Harvesting – we are actively taking tax losses in portfolios and swapping these positions into similar holdings.

- Value-oriented equities – these positions have been added to portfolios to round out exposure to more growth-oriented companies. Value stocks tend to have higher dividends and lower volatility than growth stocks.

- Minimized international exposure – while we remain strong believers in international and emerging markets diversification, our portfolio exposures outside the US remain modest. This is intentional and will likely remain this way for the foreseeable future.

- Small and mid-sized US companies – we have added exposure here, as these companies are less impacted by the strong US dollar, and they have more exposure to the direct US economy. Small and mid-cap stocks are also very inexpensive relative to US large company stocks.

- Fixed income – we have intentionally avoided longer maturity bonds. Our portfolios have consisted of short-maturity and more corporate bond exposures. As such, your bond portfolio has held up much better than the broader bond markets.

- Real assets – we believe that inflation and resource constraints may be with us for longer than most expect. As such, we have added positions to portfolios that benefit from higher inflation and specifically higher commodity prices (oil, natural gas, grains, industrial metals, etc.) This is a prudent means for diversifying in case inflation is more persistent.

- High inflationary environment investments – Made investments such as TIPS

(Treasury Inflation-Protected Securities), exposure to real estate, infrastructure, natural resources, and companies that sell non-discretionary products. These are expected to do better in high inflation environments.

While periods of drawdown and volatility are always scary, it is crucial to maintain a clear mind and stick with your plan. Locking in losses can be catastrophic to financial plans. We see volatile market as opportunities to reposition and invest new cash flows at more favorable valuations. Selling out of portfolio positions and moving into cash during market declines locks in losses and runs the risk of subsequently missing much of a future the recovery.

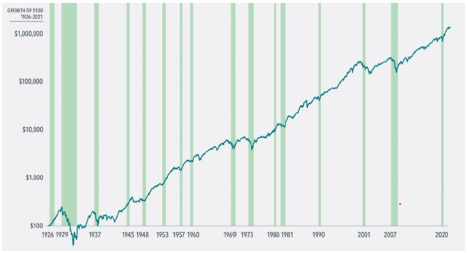

Over the last 92 years of market history, stocks have been on the rise 78% of the time.

The chart below highlights the growth of $100 in the US stock market represented by the

“Fama/French Total US Market Research Index” from 1926 to 2021, as well as periods of recession (indicated by the green shading) over that time. Market volatility is a normal aspect of investing. While there are always periods of decline, long-term investors are rewarded for keeping their discipline during and through volatile market environments.

And finally, here’s what we are seeing and thinking about re: Risks and Opportunities:

Risks:

Many of today’s risks are likely already priced into the equity and fixed income markets. The risks that may not yet be in the price include:

- A deep recession that leads to major earnings declines in most global companies

- Higher persistent inflation

- Geopolitical tensions

Opportunities:

- The rise in interest rates means that fixed income portfolios now have yield for the first time in almost a decade. We can now structure portfolios with relatively safe 4% to 5% yields. This means that with no change in price, we expect fixed income could deliver 4% to 6% returns going forward.

- More risky corporate credit is becoming interesting. We are actively watching the high yield, bank loan and preferred markets for opportunities. • Equity valuations are becoming more attractive by the day. This is true for growth stocks and value stocks, US and international equities. We are thoughtfully evaluating your portfolios to structure the best diversified mix of equity investments likely to generate solid future returns.

- Real asset investments – the dynamics created by the Russia Ukraine war coupled with global underinvestment in natural resources should present a multi-year opportunity.

Finally, we’d like to remind you that volatility and bear markets are the cost for generating long-term positive returns in the equity markets. These periods are never fun, but they do not last very long. We remain diligent in the management and oversight of your portfolios, and we are here to answer any questions you might have.