Spring Market Update 2022

Dear Valued Clients,

2022 has been a challenging year for all risk assets and even for ‘safe’ assets such as bonds. The negative impact of persistently high inflation, continuing supply chain constraints, rising interest rates, and geopolitical tensions, resulting from the Russian invasion of Ukraine, have all lead to increased volatility in both the equity and fixed income markets. As a result, 2022 was the first time since the “Taper Tantrum” of 2013 that both stocks and bonds went down in concert. Bonds have historically served as a source of stability and a counterbalance to declining stock markets. However, with interest rates increasing and the Fed signaling more rate increases to come, the role that bonds have played historically as a diversifier to reduce volatility and overall portfolio risk is not serving clients well this year, at least thus far.

We know that these markets can be very painful and even scary for our clients. We want to highlight that market volatility is an inevitable part of investing. It is healthy for markets to have corrections. To seek higher expected returns from investing in a diversified portfolio, we must accept some volatility and a certain level of downside risk. For example, someone who is invested in a very low risk certificate of deposit (CD) with an expected yield of 0.01% – 1.2% depending on the term, would not risk their initial investment, but would be effectively losing money in real terms due to inflation over the length of the deposit. “Cash drag” and purchasing power risk are significant risks that one must consider when putting their money to work especially for longer term goals.

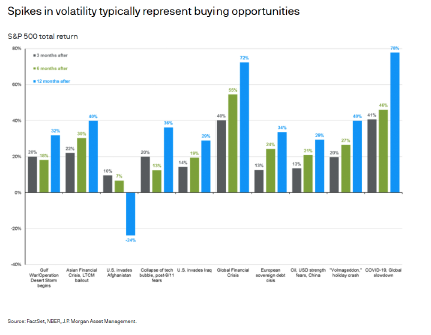

Historically the S&P 500 has performed well following extreme volatility

The chart below displays how the S&P 500 index (a good market proxy for large US companies) performed following spikes in market volatility related to various geopolitical events in recent years. As you can see the market index has typically recovered quite substantially in the months following a major market event. Point being—for long term investment goals like retirement, staying the course with a disciplined investment strategy, and ignoring the short-term noise, is often the most prudent approach.

While it may be tempting to de-risk and flee to cash, history shows us that timing the market is extremely difficult to do in practice and that the cost of sitting out of the market while holding too much cash, can be substantial. Especially in a high inflationary environment like today.

It is Important to Remember Our Planning First Approach

Cardinal starts every investment relationship by going through an extensive planning process to identify your current or future cash needs (in today’s dollars after taxes adjusted for inflation). Next, we establish your personal Investment Policy Statement which details targeted return objective, strategic asset allocation, and the level of risk accepted (this is defined by the potential volatility in your portfolio). This process is not fixed and should be updated when life events occur (i.e., retirement, selling a business, inheritance, special family needs, buying a new home, discovering large new expenses, among others). Please let us know whether you have had any life changes we are unaware of or if you anticipate needing to draw on your portfolio beyond current planned withdrawals.

Each client’s plan includes a percentage of “safe” money in cash and low duration investments that are very low volatility relative to equity markets while still earning relatively good yields given the low amount of risk taken. These “buckets” are available to fulfill your planned spending needs for next 6-months to 3-years depending on your unique situation and are also available for emergency needs. We use this strategy so that we are not forced to “realize” losses or create unwanted taxable events by selling part your investment portfolio at an inopportune time. This allows us to weather the storm and provides a greater level of flexibility.

Taking Proactive Measures While it is important to trust the planning process and your diversified portfolio to produce positive results over the long-term, we are always actively looking for opportunities when markets do correct. Here are a few actions we have taken, areas of your portfolio that are performing well, and opportunities we are waiting for the right time to act on:

- We are realizing tax losses in your portfolio by selling positions that have unrealized losses in your taxable accounts and then using the proceeds from the sales to repurchase similar investments to stay consistent with our investment approach and not miss any upside when the respective asset classes recover in the market. The IRS allows you to offset capital gains with your capital losses in any given year. Additionally, you can deduct up to $3,000 in capital losses from your ordinary income each year and carry forward remaining losses into future years.

- Interest rates have increased, and credit spreads have widened, and we believe this is a good opportunity to take advantage of widening credit spreads by reallocating funds from TIPS and short duration, that have held up relatively well, into Osterweis Strategic Income and T. Rowe Price Floating Rate which are down YTD (-4.43%) and (-1.26%) with current yields of 4.17% and 3.88% respectively. These investments have limited interest rate risk since the Osterweis Strategic Income Fund has a 2.5-year duration and the T. Rowe Fund is floating rate.

- Cardinal’s Structured Note strategy performs well when there is volatility in the stock market. The more volatility the better the yield on structured notes. Additionally, structured notes only get called away when the stock market goes straight up and therefore, we are currently fully invested. Today, this strategy has an average yield of 7.4%.

- Attractive future prospects for Growth and tech companies – who are future disruptors that will dramatically change our lives. We are waiting for the right time to add to these positions.

- Inflation is likely to persist for longer than most had thought, and the absolute level of prices is likely to stay higher for longer. As such we want to modestly increase our investment in companies that benefit from this environment. These include exposure to real estate, infrastructure, natural resources, and other investments that do well during a rising and persistent inflationary period. We’re hopeful this approach will generate solid returns over the next 12-18 months.

Final Thoughts

A lot is going in the world at the moment causing uncertainty which the markets are reacting to. The good news is that this is nothing new in that financial markets have continuously weathered geopolitical events well over the long term. Sticking to a disciplined investment approach and a customized financial plan will enable you to ride out the choppy waters.

We want to ensure all of our clients that we are on top of the current market situation and doing our best to take advantage of opportunities that present themselves.